India’s ecommerce narrative has been dominated by consumer marketplaces and D2C brands. From record-breaking festive sales and the rise of new-age brands to the explosive growth of quick commerce — consumer-facing platforms have captured most of the spotlight and conversation.

Yet, as global trade faces fresh headwinds and geopolitical uncertainties reshape supply chains, it’s the B2B side of the ecommerce story that’s becoming more consequential. A different transformation is underway on the back of favourable policy changes, increasing digital penetration, and the growing demand among MSMEs.

As global trade faces fresh headwinds and geopolitical shifts rewrite the supply chains, India’s B2B ecommerce ecosystem is beginning to emerge as the silent engine of the country’s industrial and manufacturing growth.

And among those catching attention is Moglix — one of India’s earliest B2B marketplaces.

After a decade of building a global business with headquarters in Singapore, Moglix is now preparing to redomicile and reverse flip to India ahead of a potential initial public offering (IPO) in late 2026 or early 2027.

The B2B marketplace unicorn is planning to raise around INR 500-600 Cr from the Indian public markets — a move that coincides with listing ambitions from peers like Infra.Market, Udaan, and OfBusiness.

The timing seems deliberate.

Public market investors are showing renewed appetite for tech-enabled industrial players, while India’s broader manufacturing and self-reliance narrative is gathering strength. Moglix appears to be positioning itself to ride both waves.

But with a host of other players also vying for the B2B investor attention, Moglix will have its work cut out when the IPO dates come close.

Decoding Moglix’s Evolving Business ModelFounded in 2015 by Rahul Garg, Moglix has always followed a marketplace model similar to Amazon or Flipkart, but built for businesses.

Like most other B2B ecommerce platforms, the company bridges the supply chain gap between manufacturers, distributors, and enterprises by aggregating industrial and commercial products. Though the startup catered to both institutional customers (B2B) and individual customers (B2C), the company’s main focus has been bridging the gaps in the B2B supply chain.

Moglix sources items directly from manufacturers or through dealers, keeps inventory for key SKUs, and allows businesses (retailers, enterprises, MSMEs) to place bulk or single orders through its digital platform. It also provides customised bulk orders.

On the logistics part, Moglix has its own parcel delivery platform mogliEXPRESS, which operates on bikes and mini trucks only in the Delhi-NCR region, while truck deliveries are available across India. The company also has 3PL partners for last-mile deliveries.

And it makes sense for Moglix to tap into market trends. Last year, it became the first B2B player to get into the quick commerce model with next-day delivery.

Manufacturing PushOver the years, Moglix has expanded its offering across the manufacturing sector. From welding machines to bathroom taps, automotive engine oil and grease to stethoscopes and microscopes, equipment for various industries are aggregated and listed on its platforms for end buyers to purchase.

While Moglix did not respond to Inc42’s questions on which categories are driving its revenue growth and how it is evolving with the changing geopolitics, it looks like something is shifting under the hood for the company.

For instance, in 2023, Moglix entered manufacturing through the acquisition of Khatema Fibres, a sustainable paper and packaging company. This year, it further deepened that strategy with a bitumen plant in Mathura.

This vertical integration hints at a new shift — from aggregator to industrial manufacturer.

But that’s not all. The company’s entry into bitumen manufacturing for roads also hints at a growing market demand for construction materials in India, an area where Infra.Market has championed for years.

The Global FootprintAdditionally, it also onboarded a fresh cohort of global electronics suppliers recently, across Switzerland, India, and China. This also hints at the company’s attempts to tap into India’s surging demand for electronic components, as its auto, semiconductor, and other IoT segments grow.

Although the B2B marketplace unicorn has operations spanning India, Southeast Asia, the UAE, and North America (and is attempting to expand its global presence), it earns a majority (96.3%) of its revenue from India, followed by the UAE (3%).

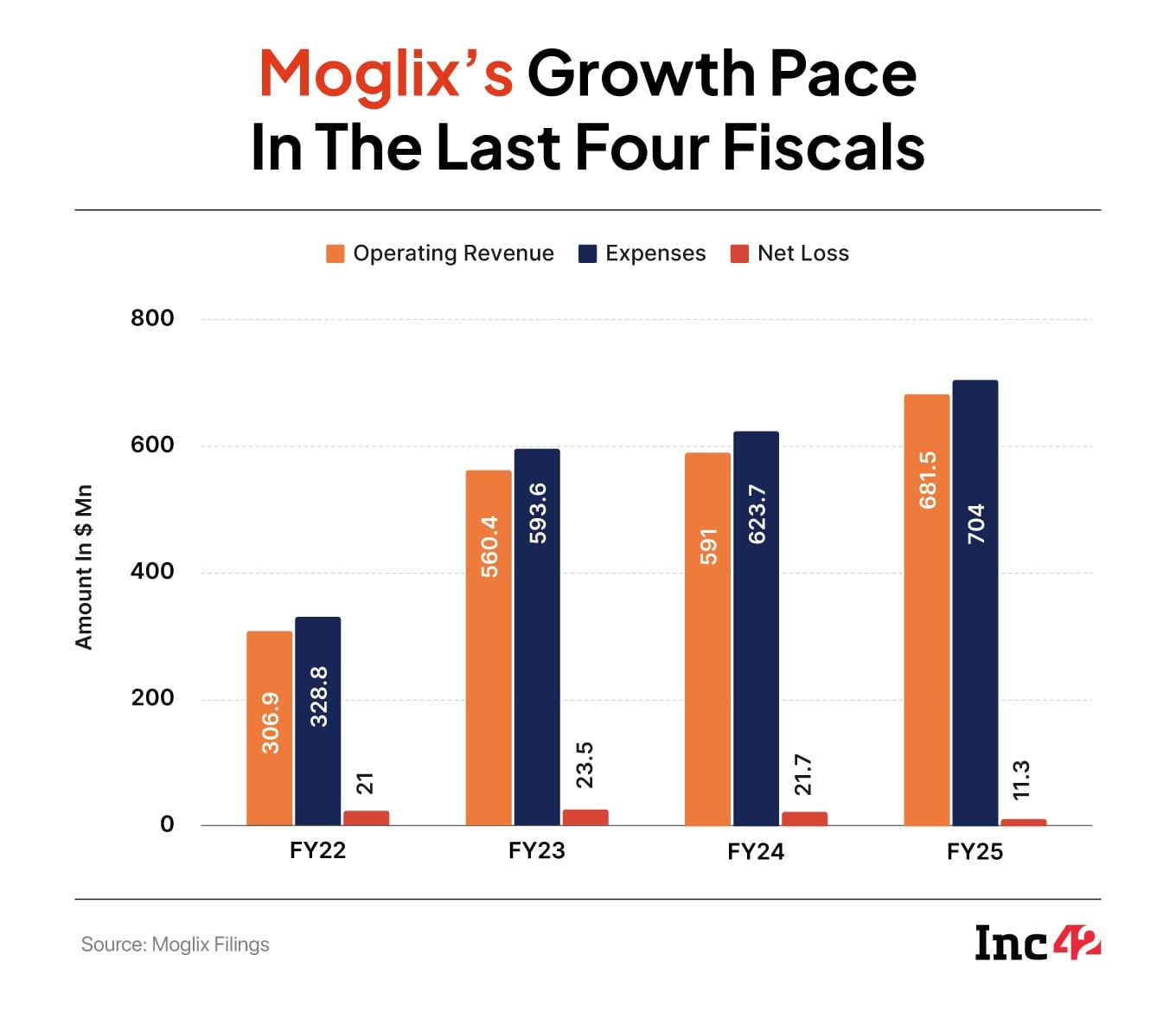

But, amid all this growth and opportunities, it is pertinent to note that the company continues to remain in the losses. It posted a net loss of $11.3 Mn in FY25 on an operating revenue of $681.5 Mn.

Founder and CEO Rahul Garg told Inc42 back in 2019 that it was chasing growth over profitability. But the market has changed since then, as even Garg will acknowledge, and the pressure for profits is clear, especially when the competition is doing that.

In early 2021, Moglix turned a unicorn by raising $120 Mn in Series E, and soon after, it made three back-to-back acquisitions.

It expanded its supply chain by acquiring the used machinery marketplace Vendaxo, forayed into the supply chain financing space with Credlix, and then Credlix acquired Singapore-based NuPhi, strengthening Moglix’s position in the export-import space.

But all that has not delivered the elusive profits. So, after raising close to $600 Mn and with a valuation of $2.6 Bn, what is really stopping Moglix from turning profitable, especially when it wants to tap the global opportunity and is not just looking at India?

Can Moglix Stem Its Losses?There’s no denying that the Covid-19 pandemic has reshaped how the world shops, ushering in a new era of retail and ecommerce.

Investors had perhaps sensed a shift towards digital procurement and B2B supply early on, and within just five months in 2021, the ecosystem saw the emergence of three unicorns that came to define the space: OfBusiness, Infra.Market, and Moglix.

Unlike OfBusiness, Infra.Market, or even Udaan (already a unicorn by then) – who had focussed sectors – Moglix was more of a generalist.

The company started building its digital-first procurement and supply chain platform in 2015, and by 2019, it was serving the automotive, metals, mining, and fast-moving consumer durables (FMCD) markets with more than $100 Mn raised from marquee investors such as Tiger Global and Accel.

After the first year of the pandemic, as factories reopened and industries sought greater visibility, efficiency, and trust in sourcing, Moglix’s model – spanning procurement, supply chain financing, and technology solutions – found strong tailwinds. But this growth was never profitable.

In FY19, the company’s revenue was at a mere INR 217 Cr ($30 Mn), which surged 74% to INR 378 Cr ($49 Mn) in FY20. The next year, it doubled to INR 776.6 Cr (around $106 Mn) and that tripled to more than INR 2,300 Cr ($306.9 Mn) in FY22.

The scale of its growth has undoubtedly been impressive, but the company’s losses only kept widening. And it was only in FY25 that Moglix managed to lower its losses and move towards profitability.

The scale of its growth has undoubtedly been impressive, but the company’s losses only kept widening. And it was only in FY25 that Moglix managed to lower its losses and move towards profitability.

Sachin Jain, cofounder and CFO at B2B procurement platform ProcMart, said that one of the biggest challenges of working in a marketplace model is that return rates are as high as 20% in this business, which increases costs.

“There are more nuanced challenges here compared to B2C ecommerce: businesses need standardised products, specifications of machines and tools have to match correctly, and so on. This increases the risks of rejections and returns high in the marketplace model,” Jain added.

A hybrid model involving procuring goods for bulk customised delivery to enterprises only would have been more profitable in the short term before Moglix expanded to other areas. The fact that even Infra.Market and OfBusiness have turned profitable has added to some pressure on Moglix.

This could also be attributed to Moglix’s global vision when it comes to scale and a more diverse category choice. As the startup prepares to go public in India, the unicorn’s path to profitability will be more pertinent than ever.

Meanwhile, market experts claim that despite the current India-US trade tensions and other geopolitical uncertainties, B2B ecommerce has no growth hurdles because the market depth is unmatched.

“GST, e-invoicing, and ONDC have made procurement a boardroom priority. CFOs are finally okay buying online. Credit is the new currency. Embedded finance interwoven with an order approval into a one-click process is an innovation that helps. For cash-strapped SMEs, which is the case with many Indian SMEs, this can be a game-changer,” added Anil Pillai, director at Terragni Consulting.

He believes that Moglix, Infra.Market, and IndiaMART are proof that profitability is possible in B2B marketplaces by going deep, not wide.

What Lies Ahead For Moglix?As India pushes its “Make in India” initiatives, B2B marketplaces will play a central role in enabling industrial efficiency and SME growth.

However, one area continues to remain tricky in B2B: compliance.

As Rishi Agrawal, CEO and cofounder of Teamlease Regtech, noted, compliance in the B2B space is about business standards, tax accuracy, and contractual obligations as opposed to B2C compliance, which focuses on consumer rights and transparency.

Several taxation-related changes have taken place over the years. Even the recent DPDP Act and its rules impact B2B platforms with hybrid B2B2C models or those processing client data, requiring data protection officers for significant data fiduciaries.

Besides, in a diverse B2B marketplace (spanning electrical, manufacturing, construction, medical, automotive, among others), some sectors carry much heavier compliance burdens, said Agrawal.

This is most apparent in the case of medical or healthcare devices and equipment, which requires licensing (import and manufacture), detailed documentation, adverse-event reporting, and now strict marketing ethics – which increases compliance overhead.

Similarly, other segments have safety norms and quality standards that are non-negotiable.

A manufacturer like Moglix that functions in these sectors has to abide by the compliance regulations. Meanwhile, the startup works with a global supply chain, some even from China, which always carries a certain political risk.

“Selling imported industrial equipment is certainly possible, but complex… But some trade barriers have eased. Authorities have signalled a shift by letting certain tariffs on Chinese inputs expire, indicating that compliant products can enter if regulations are met,” Agrawal added.

Meanwhile, Terragni Consulting’s Pillai said that India’s relationship with Chinese machinery and tools is now that of “cautious dependence.”

“Imports are still up, but the fear of disruption is real. Winners will be platforms that multi-source, offer traceability, and guarantee availability. In B2B, high velocity, friction-free, predictable reliability has become a set of key features you can bank on.”

Moglix, having been around for more than a decade and with its vision around building a global supply chain, will be expected to balance the risks with the upside in this volatile geopolitical situation. What is inarguable is that its business model carries more regulatory uncertainties compared to the B2C or D2C marketplace players.

While compliance will be a major target for the company, the biggest test for Moglix is its profitability. As it helps SMEs scale and enterprises drive India’s manufacturing and exports story, will the B2B marketplace emerge profitable ahead of its IPO by 2027?

[Edited by Nikhil Subramaniam]

The post Away From The Buzz: How Moglix Built A $700 Mn Global B2B Marketplace appeared first on Inc42 Media.

You may also like

Meet Japan's 'Iron Lady' Sanae Takaichi: First woman Prime Minister facing big political, economic, and regional challenges

'Shoot it up': Family tip-off helps Georgia police prevent possible Atlanta Airport mass shooting

Brit mum buys 'world's most haunted doll' with horrifying consequences

Bihar elections: Why Nitish and Tejashwi still call the shots; can Prashant Kishor break the two-front curse?

BPCL to host global Energy Technology Meet in Hyderabad next week