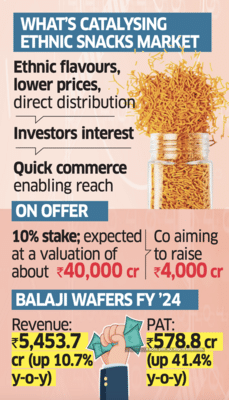

ITC and PepsiCo along with a clutch of private equity firms such as TPG and Temasek are competing for a 10% stake in privately-held snack maker Balaji Wafers at an expected valuation of nearly ₹40,000 crore, said people aware of the developments.

“A combination of strategic investors and private equity players are being tapped,” said one of the persons cited above. “Some of the discussions with strategic investors are in exploratory stages, as the players are keen on acquiring a stake of over 10%.”

It is the second attempt by PepsiCo to acquire a stake in Rajkot-based Balaji Wafers, which has a strong presence in western and central India.

The US snack foods and beverage multinational had in 2013 discussed with Balaji about purchasing a stake in the latter, a potential deal the company’s global chief executive Indra Nooyi had been keen at the time. PepsiCo however eventually backed out as it wanted to buy a 49-51% stake in Balaji Wafers, something that the promoter Virani family wasn’t interested in.

The developments underscore rising investor interest in regional snack brands in India who have been outpacing the bigger companies in this growing market. In March, global investors IHC, Alpha Wave Global, and Singapore’s Temasek together bought nearly 10% of Haldiram Snacks Food at over $10 billion valuation, the biggest deal so far in the domestic packaged food sector.

ITC’s own snack brand, Bingo, which it had introduced in 2007 to make and sell potato wafers and later salty snacks, faces aggressive competition from larger brands—both in western and ethnic formats. Bingo also continues to be a smaller brand within ITC’s food portfolio compared to the company’s other brands Aashirvaad atta and Sunfeast biscuits.

On the other hand, PepsiCo, which leads in western snacks such as chips and nachos, has been losing share to regional brands in the ethnic snack category.

“Now, however, the dynamics of the snacks market have changed completely, with a resurgence of smaller brands dominating the snacks market,” a second person said. “An alliance with the regional giant such as Balaji, even a minority, would give PepsiCo significant backend upside in cracking regional markets and backend manufacturing synergies.”

ITC, PepsiCo and Temasek did not respond to queries. TPG declined to comment. Chandubhai Virani, founder and managing director of Balaji Wafers, could not be reached for comment.

SMALL BRANDS, BIGGER POWER

New York-based PepsiCo is sharpening focus on snacks, with its soft drink bottling and distribution business under which it sells Pepsi and Mountain Dew carbonated drinks, and Slice and Tropicana juice drinks, being managed almost entirely by franchise partner Varun Beverages.

Balaji Wafers reported revenue of ₹5,453.7 crore in FY24, a 11% increase. Profit after tax grew 41% to ₹578.8 crore, according to the company’s filings.

“The diversified Virani family is looking to streamline operations and hand over day-to-day business to professional managers,” a third person said. On September 9, another family-run domestic legacy company, Vadilal Industries, appointed its first non-family CEO Himanshu Kanwar, after the ice cream maker completed a restructuring exercise, which was also aimed at separating ownership from management.

According to market researcher Imarc Group, the Indian snacks market, valued at ₹42,694.9 crore in 2023, is projected to more than double to ₹95,521.8 crore by 2032.

“A combination of strategic investors and private equity players are being tapped,” said one of the persons cited above. “Some of the discussions with strategic investors are in exploratory stages, as the players are keen on acquiring a stake of over 10%.”

It is the second attempt by PepsiCo to acquire a stake in Rajkot-based Balaji Wafers, which has a strong presence in western and central India.

The US snack foods and beverage multinational had in 2013 discussed with Balaji about purchasing a stake in the latter, a potential deal the company’s global chief executive Indra Nooyi had been keen at the time. PepsiCo however eventually backed out as it wanted to buy a 49-51% stake in Balaji Wafers, something that the promoter Virani family wasn’t interested in.

The developments underscore rising investor interest in regional snack brands in India who have been outpacing the bigger companies in this growing market. In March, global investors IHC, Alpha Wave Global, and Singapore’s Temasek together bought nearly 10% of Haldiram Snacks Food at over $10 billion valuation, the biggest deal so far in the domestic packaged food sector.

ITC’s own snack brand, Bingo, which it had introduced in 2007 to make and sell potato wafers and later salty snacks, faces aggressive competition from larger brands—both in western and ethnic formats. Bingo also continues to be a smaller brand within ITC’s food portfolio compared to the company’s other brands Aashirvaad atta and Sunfeast biscuits.

On the other hand, PepsiCo, which leads in western snacks such as chips and nachos, has been losing share to regional brands in the ethnic snack category.

“Now, however, the dynamics of the snacks market have changed completely, with a resurgence of smaller brands dominating the snacks market,” a second person said. “An alliance with the regional giant such as Balaji, even a minority, would give PepsiCo significant backend upside in cracking regional markets and backend manufacturing synergies.”

ITC, PepsiCo and Temasek did not respond to queries. TPG declined to comment. Chandubhai Virani, founder and managing director of Balaji Wafers, could not be reached for comment.

SMALL BRANDS, BIGGER POWER

New York-based PepsiCo is sharpening focus on snacks, with its soft drink bottling and distribution business under which it sells Pepsi and Mountain Dew carbonated drinks, and Slice and Tropicana juice drinks, being managed almost entirely by franchise partner Varun Beverages.

Balaji Wafers reported revenue of ₹5,453.7 crore in FY24, a 11% increase. Profit after tax grew 41% to ₹578.8 crore, according to the company’s filings.

“The diversified Virani family is looking to streamline operations and hand over day-to-day business to professional managers,” a third person said. On September 9, another family-run domestic legacy company, Vadilal Industries, appointed its first non-family CEO Himanshu Kanwar, after the ice cream maker completed a restructuring exercise, which was also aimed at separating ownership from management.

According to market researcher Imarc Group, the Indian snacks market, valued at ₹42,694.9 crore in 2023, is projected to more than double to ₹95,521.8 crore by 2032.

You may also like

Yu Menglong dead: Netflix's Eternal Love actor dies at 37 after 'falling from building'

Railways: Which seat is vacant in which coach of the train? This is the easiest way to find out..

India vs Pakistan: Virat Kohli and Hardik Pandya top leaderboards; here are key T20I and Asia Cup stats

SSC exams: Cheating in SSC exams will cost heavily, preparations underway to ban candidates for tampering with computers..

Aadhaar Tips: The easiest way to correct the name in Aadhaar card, the work will be done in just 3 minutes..